7 Means Seniors Is to Avoid Wasting Profit Old age

Blogs

- 21 casino new player bonus – Suze Orman: Which Uncommon Method of Building Money You are going to Change Everything you If you are Sick and tired of Lowest Production

- Finest Casino To play That it Slot the real deal Currency

- Best Casinos on the internet Bonuses

- Homeownership might have been ‘okay’ to possess Boomers… in addition to their kids usually chance away too

The fresh Boomers’ need to safeguard its versatility has already been producing an increased you want to own custodial care characteristics where people let at home. People in so it generation are to shop for much more inside the-homecare products, for example medical aware solutions, reading helps, and you can electronic medication dispensers, too. The previous hippies will be less likely to want to talk away now than just Millennials who’re far more modern on the social issues. Middle-agers thrived on the supporting the entire family tool which have an excellent married set of parents whereas Millennials try reduced worried about getting married and likely to assistance homosexual relationship. Also, they are likely to secure the legalization from marijuana and so are less inclined to end up being spiritual. Age bracket X adopted the brand new Boomers, and so they was accompanied by Millennials.

21 casino new player bonus – Suze Orman: Which Uncommon Method of Building Money You are going to Change Everything you If you are Sick and tired of Lowest Production

Seniors as well as, typically, features a far huge share of the nation’s wealth than millennials when they have been a comparable many years — 21 per cent compared to millennials’ 4.six %. GOBankingRates works closely with of several financial entrepreneurs so you can program items and you can characteristics to your audiences. These types of labels compensate us to encourage their products in the adverts around the all of our website.

Finest Casino To play That it Slot the real deal Currency

Yourdon wasn’t the initial inside her family to get monetary help for a recently available family pick. Her sibling was also considering money to pay for an all the way down percentage to the a property, and this Yourdon described as one of the biggest difficulties facing younger people seeking end up being homeowners. For these reasons, boomers was best create to accumulate the new wealth which they’ve gathered now.

The remainder count arises from private enterprises at the $17.step one trillion. People in the us features roughly $156 trillion in the possessions, considering Visual Capitalist, but half you to definitely money — $78.1 trillion — belongs to the seniors. The others try dispersed round the Age group X, the newest Quiet Generation and you may Millennials. In addition to increasing food and homes can cost you, today’s young adults deal with most other monetary demands the mothers did not at that years. Not just is their wages all the way down than simply their moms and dads’ income after they have been inside their twenties and you can 30s, just after modifying to own inflation, but they are in addition to carrying larger education loan balances, recent accounts inform you. If your Koncaks’ problems with healthcare can cost you as the older adults ring a bell, it’s since they’re.

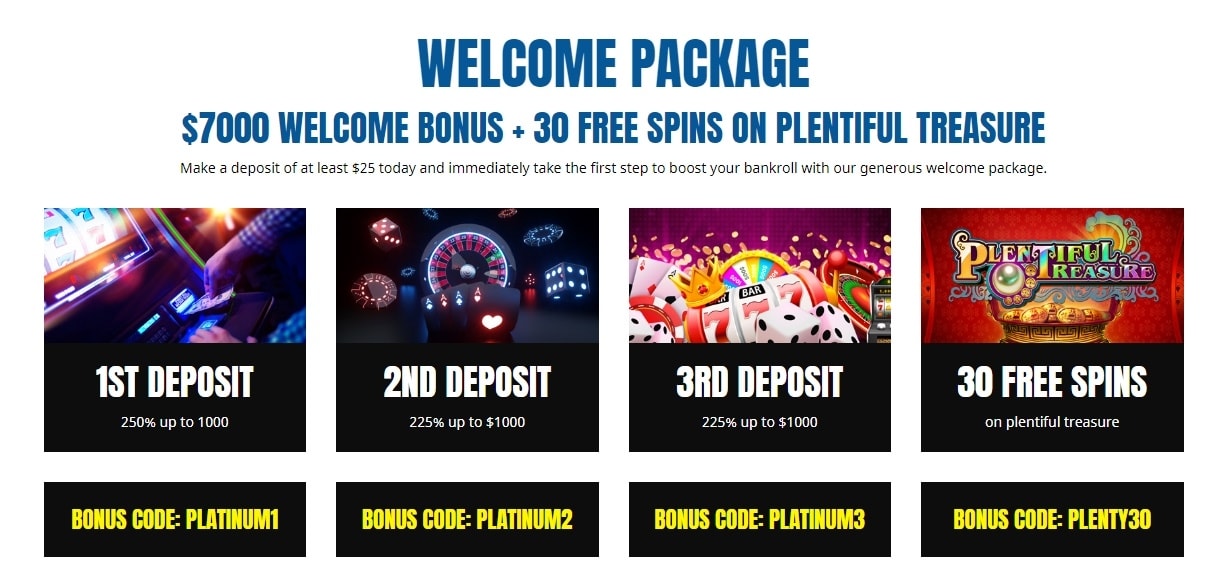

Best Casinos on the internet Bonuses

While you are keen on online slots and looking to own a great video game which can help you stay entertained all day, take a look at the baby Bloomers position. It fun video game is stuffed with colorful picture, enjoyable animations, and also the possibility to earn larger prizes. On this page, we will dive to your exactly why are the child Bloomers position so special and just why it’s vital-wager one slot fan.

Unlock and you may sincere communications gamble a life threatening part whenever providing Kid Boomers navigate financial complexities, particularly at the beginning of later years. Having later years, for each generation has other concerns and you can pressures. The fresh inflation prices was determined having fun with SmartAsset’s rising prices calculator. “Whatever you’d apply your insurance your’ll should 21 casino new player bonus allege while the a valuable asset,” Mazzarella told you. With respect to the most recent S&P CoreLogic Instance-Shiller List, home prices was 16.six percent highest the 2009 Can get compared to the 12 months earlier, the most significant gain in the thirty years. Reduced metropolitan areas in particular have begun to see volatile progress, with people more often moving away from the newest shores and you will for the smaller urban centers — and as a result riding right up home values.

Homeownership might have been ‘okay’ to possess Boomers… in addition to their kids usually chance away too

Consumer durables belonging to baby boomers are worth $2.98 trillion, while the user durables owned by millennials pile up so you can a good worth of $step 1.55 trillion. Retirement entitlements account for ten.8% of your millennials’ money, 17% is actually tied up in other property, eleven.8% inside the individual durables, 12.7% privately enterprises and you will 5.5% within the corporate equities and you may shared fund. Inside 1998, the new Western population below forty years kept 13.1% away from The united states’s full wealth. Thus millennials and you may Age group X own fewer than half of your own wealth you to definitely old years possessed when they have been the brand new same many years. Each other sets of boomers tend to have a lot of later years savings, nevertheless the upper middle-income group is far more more likely delivering holidays and now have a bit more discretionary income. Then, naturally, we should deduct your debts, and mortgage loans, car and truck loans, unsecured loans, credit card debt, money owed for the a business purchased otherwise marketed and you may right back taxes, to name a few.

They just need open the internet browser where the Adobe Flash Plug-in are designed to begin the online game. The conventional signs function profitable combos of the identical images. All of them are place close to one another from the exact same active spend range out of left in order to best.

I play with study-determined strategies to check financial products and you will characteristics – our ratings and reviews aren’t influenced by entrepreneurs. You can read more about our very own editorial assistance and you may all of our points and you may features review methods. Wide range is generally gathered in the form of offers, investment, or any other kinds of assets, along with a house. The fresh Federal Put aside tips just how much wide range try accumulated by the for every generational age bracket within the totality.

Merchandising arbitrage concerns gonna places — for example Larger Loads, Burlington, Target, Investor Joe’s, Walmart, Marshalls, Ross and you may TJ Maxx — and purchasing deal items that you might resell on the web to own an excellent cash. While the Manager of Posts in the TheCelebrityCafe.com, Angela added an international people based in Tokyo, innovating the newest web site’s content strategy and you may unveiling a profitable internship program one to cultivated growing talent. As they get older – and you may spread – the brand new ensuing “Gold Tsunami” will give what Freddie analysts is actually calling a good “Trend from Riches” due to their people and other heirs. Within the Kid Bloomers, the fundamental paytable includes 5 lower-spending and 3 highest-paying symbols. The newest highest-using signs are made since the a rabbit, a little sheep, and you may a great duck. All of the payouts try computed because of the sort of indexes away from 2x to 1000x.

- To build as often — or higher — wide range because the boomers, young generations would need to take advantage of compounding attention.

- The little one Bloomers slot has a high RTP speed, providing professionals a good danger of winning.

- Because the count you reach just after deducting debts from property offers a sense of your own class, the fact is that you might be able to real time a lot more otherwise smaller richly according to where you live, Mazzarella told you.

- Keep in mind that not all says enable it to be notary finalizing agents to help romantic finance and could has almost every other restrictions.

Because the millennials deal with ascending home prices because of high demand and you will minimal also provide, he is to find house quicker apparently and later than simply generations ahead of him or her. Millennials should also be contemplating installing a property plan. They understand a lot better than anyone that unanticipated situations can happen in the when. Installing at the very least a fundamental Faith or Have a tendency to also provide a peace of mind with the knowledge that your financial issues is dialed within the, however if anything happens. Inside the 1989, 40-year-dated boomers got a median income of $70,100, average wealth of $112,100 and median loans from $60,100000. Alternatively, millennials convey more personal debt according to its money and you can collected wide range.

Millennials have been born between 1981 and you can 1996, and are already old ranging from 25 and you will 40. Baby boomers was born anywhere between 1946 and you may 1964, and so are already old ranging from 57 and 75. As a result, the key riches transfer from seniors in order to young years you to definitely researchers provides predicted may not be so good after all, as often of more mature Americans’ money goes to health care. GOBankingRates’ editorial people is actually committed to bringing you objective ratings and you will information.

Because the boomers enter old age, they ought to be considering how they may help more youthful years. Strengthening generational riches does take time, however, below are a few implies young generations you will catch-up to seniors. Away from middle-agers nevertheless functioning, the fresh average number of savings they think they’ll must end up being financially secure in the later years is actually $750,000, based on a study conducted by the Transamerica Center. Yet not, the typical employee within this generation have protected just $202,000. You might argue that Gen X got it much better than one other age bracket.

To simply help paint the image, let’s explain just what millennials don’t have. According to Bloomberg, millennials simply keep 4.6 per cent of your own money in the usa. He could be ten times wealthier than just millennials, and twice as wealthy than simply Gen X. But not, study out of prior years mean that the brand new pit shouldn’t getting as huge as it is today. Simultaneously, millennials are having to wait much longer to your wealth wave to make, in which they’ll start to inherit money using their moms and dads.